modified business tax refund

Selfemployedproduct Tax Forms Job Info Self Assessment Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions W2 Forms Tax Forms Ways To Get Money. Employer paid health care costs paid this calendar quarter.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

. The Commerce Tax return is due 45. Modified Business Tax NRS 463370 Gaming License Fees. The proposal initially failed to garner a two-thirds majority when all Republicans opposed it but Democrats then amended the bill by removing the two-thirds.

Modified Business Tax has two classifications. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line. And ordered the Department of Taxation to refund any overpayment of the Modified Business Tax plus interest.

See reviews photos directions phone numbers and more for Virginia Tax Refund locations in Ashburn VA. Click the tool in the top toolbar to edit your Modified Business Tax Return Nevada on the specified place like signing and adding text. On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada Department of Taxation to refund any overpayment of the Modified Business Tax plus interest to businesses.

September 30 2016 is 3000. Benjamin HagerLas Vegas Review-Journal The Nevada State Seal on the north side of the Legislative. A partial abatement of the business tax during the initial period of operation is available.

Enter your official contact and identification details. Since the 2nd quarter of 2013 paper tax returns under the codes of NVGBT and NVFBT have also been added to the quarterly tabs for filing purposes. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Ashburn VA.

The Commerce Tax is an annual tax passed by the Nevada Legislature during the 2015 Legislative Session. The Nevada Department of Taxation has sent out the first round of refund checks to businesses that paid a tax recently struck down by the states Supreme Court as being unconstitutional. However the first 50000 of gross wages is not taxable.

Credits - Enter amount of overpayment of Modified Business Tax made in prior reporting periods for which you have received a Department of Taxation credit notice. 1st round of modified business tax refunds sent to businesses in Nevada. The following tax codes create transfers and liability records.

To get started on the blank use the Fill camp. Sign Online button or tick the preview image of the blank. Qualifying employers are able to apply for an abatement of 50 percent of the tax due during the initial four years of its operations.

Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and were not reduced to 1378 and 1853 respectively. How you can complete the Nevada modified business tax return form on the web.

The credit may only be used for any of the four calendar quarters immediately. NVFBT Financial Institutions Business Tax. Do not take the credit if you have applied for a refund.

December 31 2016 is 3500. Commerce Tax Credit Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. BUSINESS TAX GENERAL BUSINESS.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. March 31 2017 is 3000. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans.

The advanced tools of the editor will lead you through the editable PDF template. June 30 2017 is 3000. On August 15 2016 a business filed its Commerce Tax return and paid 20000 in Commerce Tax.

Credit notices received from the Department are not cumulative. Do not enter an amount less than zero. NVGBT General Business Tax.

Click the Download button to keep the. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately following the end of the Commerce Tax year for which Commerce Tax is paid. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

Only credits established by the Department may be used. Modified business tax refund Friday March 18 2022 Edit. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter.

Select the CocoDoc PDF option and allow your Google account to integrate into CocoDoc in the popup windows. Senate Bill 551 emerged when the Democrat-led Senate passed a bill in the 2019 session that extended a higher rate for the modified business tax payroll tax that was otherwise set to revert to a lower level. The Modified Business Tax liability before applying the Commerce Tax credit for the quarter ending.

The Department is developing a plan to reduce the Modified Business Tax rate for quarters. The DOT has been ordered to refund to businesses the excess tax collected plus interest from the date of collection. Exceptions to this are employers of exempt organizations and employers with household employees only.

MODIFIED BUSINESS TAX Commerce Tax An employer pursuant to NRS 363A and NRS 363B is entitled to subtract from the calculated Modified Business tax a credit in the amount equal to 50 of the amount of the commerce tax paid by the employer. The tax is imposed on businesses with a Nevada gross revenue exceeding 4000000 in the taxable year. While you may want to splurge on a big-ticket item the smartest financial move is to carefully manage your refund to maximize your dollars.

There are no current options for filing this return. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 for General Businesses Financial Institutions and Mining and will soon announce when the. Choose the PDF Editor option to move forward with next step.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

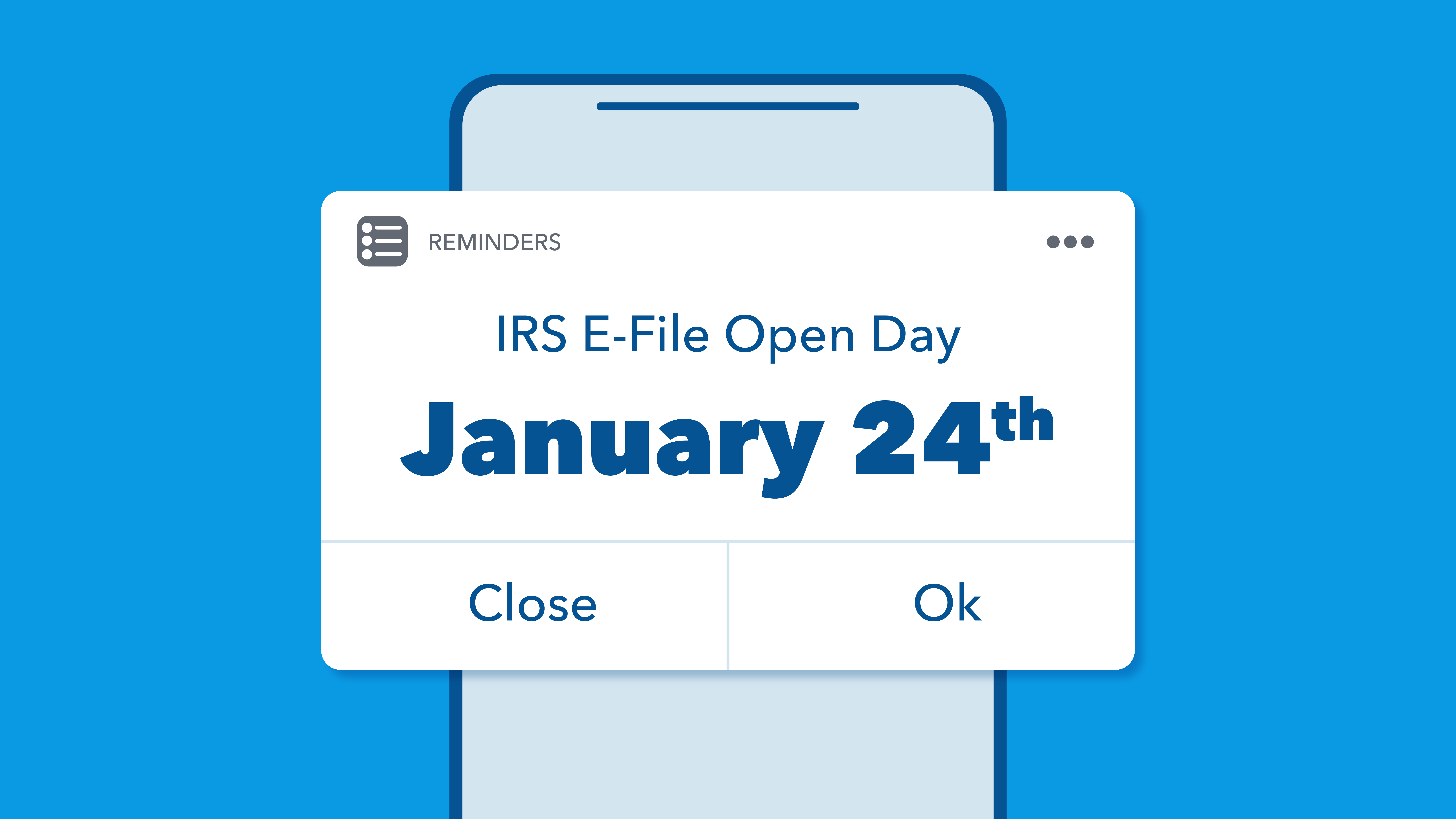

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Common Irs Audit Triggers Bloomberg Tax

Employee Retention Tax Credit Significantly Modified And Expanded For Businesses Shindelrock

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)